Mail Theft in 2024: FinCen Alerts Banks of Growing Crime

Recently, the Financial Crimes Enforcement Network (FinCEN) sounded the alarm on a concerning trend: a widespread increase of mail theft targeting the USPS (United States Postal Service) specifically when it comes to checks being stolen from USPS mailboxes.

FinCen sent out an alert on February 27, 2024 in close collaboration with the USPS that underscores the importance for financial institutions to fortify their defenses against such threats. Trends to watch out for were outlined in the alert, but no real solution was given.

Understanding the Threat of Mail Theft

Check fraud has long been a concern for financial institutions, but the latest surge in schemes targeting the USPS adds a new dimension of vulnerability. 17 Billion checks are exchanged each year in the US, and criminals are exploiting weaknesses in the mail system to intercept checks, alter their details, and cash them fraudulently. This not only leads to financial losses but also erodes trust in the integrity of the banking system.

FinCen’s Alert of Mail Theft

FinCEN's alert on mail theft was sent in close collaboration with the United States Postal Service, and serves as a wake-up call for financial institutions to enhance their anti-fraud measures, properly submit suspicious activity reports, and warn them of red flags to watch out for.FinCen outlines that mail theft complaints and cases have been on a consistent upward trend since the pandemic.

As you may have read in some of our other blog posts, the number of suspicious activity reports in 2021 doubled to 680,000 over 350,000 in 2021. With relief checks being sent to both individuals and businesses during the pandemic, these mail fraud statistics were expected to increase, but the trend is still moving upward years later.

In the alert notification, FinCen gives banks and financial institutions a guide of what to look out for, such as:

- Non-characteristic large withdrawals

- Complaints of checks being deposited into an unknown accounts.

- Complaints of checks never being received after mailing.

- Checks used for withdrawing money from a client's account are printed on a distinct kind of check paper.

- Current clients who have never deposited checks before are now unexpectedly depositing or transferring money.

- Unusual, abrupt, and irregular check deposits, frequently done electronically, followed by swift withdrawal or fund transfers.

These red flags are not only the result of USPS mail theft, but more specifically, check washing. Check washing is the technique in which fraudsters will use household chemicals to “wash” toner or ink off of a check to change the payee name to be deposited into their own account for a larger amount.

These schemes can become more advanced or layered, but targeting the USPS and physical checks seems to be a more popular technique, as it is now accounting for $815 Million in financial losses, according the Better Business Bureau.

The Solution to Check and Mail Theft

Yes, all of these warnings and red flags will help financial institutions better identify when check fraud and mail fraud have occurred. But, what FinCen fails to mention in their report is the foolproof solution to check fraud that exists with TROY group.

TROY is at the forefront of developing cutting-edge solutions to combat check fraud. Leveraging advanced technology and expertise, TROY offers a range of products and services tailored to the needs of financial institutions.

With TROY’s solutions, financial institutions gain peace of mind knowing that even if USPS mailboxes are broken into and check theft is committed, their customer's and client payments are safe and secure.

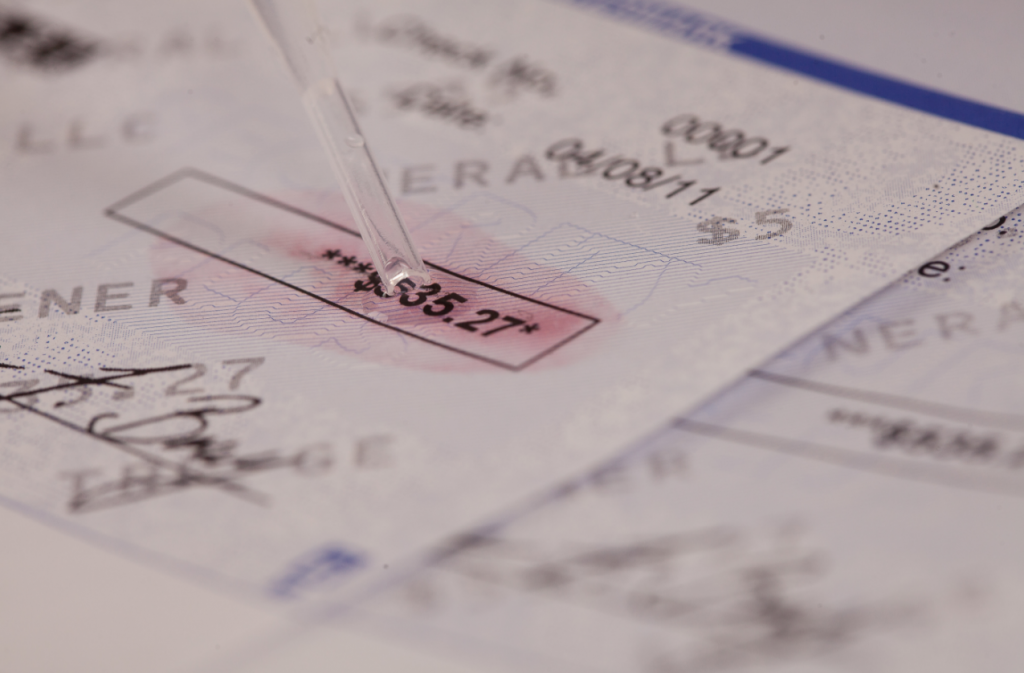

TROY’s MICR Toner Secure is the answer to protecting checks with upfront security. MICR Toner Secure™ is TROY’s patented anti-tamper fraud solution that contains our patented red dye within the MICR toner. MICR Toner Secure™ can be used to print the MICR lines and amount on a check, the most commonly washed areas of the check.

The Benefits of MICR Toner Secure™

If any kind of chemical alteration is attempted on a check printed with TROY MICR Toner Secure™, the characters will bleed red, alerting the banks of fraud.

TROY is the only company in the world offering these capabilities. With check fraud becoming its own pandemic of sorts, active security on checks is needed now more than ever.

MICR Toner Secure ™ is also undetectable by fraudsters. They would not be able to tell if the check has this security unless they tried to commit the crime first.

MICR Toner Secure™ also exceeds the strict American Banking Association standards for MICR. Each check you print with MICR Toner Secure™ will have a strong MICR signal and will be easily read by machines used by the bank in order to avoid manual entry.

TROY’s Secure Check Fraud Solutions:

MICR Toner Secure™ isn’t the only security solution TROY offers. TROY suite of hardware and software solutions makes it easy to your own checks with first class MICR printers, blank check stock, and revolutionary check printing software as well – giving you a complete secure solution even before you start printing.

Secure MICR Printers: Through our OEM partnership with HP, TROY is takes a standard HP printer and enhances it with the capability to securely print MICR on checks. These MICR printers come with advanced security features such as exact positioning technology so your MICR lines are printed correctly, unique user verifications, toner sensing, and more.

Blank Check Stock: Blank check stock is the first step in securing your finances. Pre-printed stock comes with your account information already printed, blank check stock lets you start from the beginning. Blank check stock is inherently more secure, but TROY’s Fortress Check Paper come with 20 advanced built in technologies that protect against copying, alteration, and counterfeiting.

Secure Check Printing Software: Our check printing software allows you to protect your financial information before you hit print. Cloud-based software AssurePay Check for large businesses and TROY FlexPay for small businesses both utilize advanced security features that let you print your company checks from one secure platform.

How to Stop Mail Fraud

In an era where financial fraud is becoming increasingly sophisticated, proactive measures are essential to safeguarding the integrity of the banking system. FinCEN's alert serves as a timely reminder of the evolving threats facing financial institutions, particularly concerning the surge in check fraud schemes targeting the U.S. Mail. However, with innovative solutions like those offered by TROY, financial institutions can bolster their defenses and stay one step ahead of fraudsters.

If you’re business or clients are experiencing mail theft or check tampering, file a Suspicious Activity Report (SAR) immediately, and contact the USPS to report.

Related Posts

UV vs Solvent vs Water-Based Inks: Which Is Best for Industrial Applications?

The type of ink used for industrial printing plays a critical role in print quality, durability, production speed, and environmental impact. The three most common ink types; UV..

The Importance of MICR Check Printing in 2026

If you work in the financial industry like in a bank, or even in a department like accounts payable or payroll - you probably know what MICR is, but then again, you might not. The..

Leave a Reply